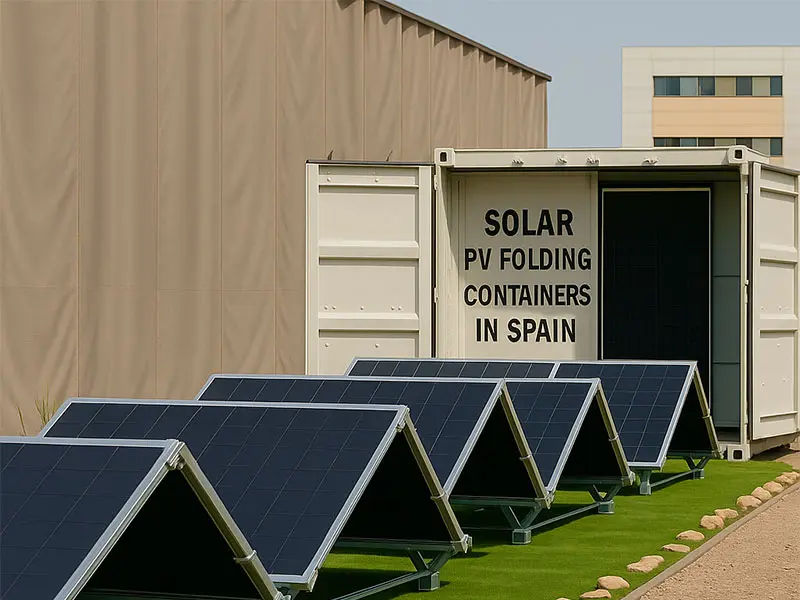

Currently, Spain is an avant-garde in energy futures. Since tariffs have been heightened by 22% in the year 2023 and EU green regulation is surging by 42% in the year 2030, the companies are demanding innovative solutions. Therefore, solar foldable container modules are the most in-demand in Spain, especially where land space is an issue, and resources are scarce. These module designs are very easy to work with, and can very conveniently be erected in less than 3 days, thereby changing the face of solar energy in Spain.

Spain Embraces Solar PV Containers with Open Arms

1. Novel subsidy and policy trends

The Spanish National Energy and Electricity Commission (PNIEC) hopes solar energy installations will reach 76 GW by 2030, where 19 GW shall stem from self-use contracts. This means that hybrid storage subsidy allocation in 2024 will accrue mostly to solar container battery storage solutions- that is, mostly Tesla Powerpack-compatible. The EU's Renewable Energy Directive and Renewable Directive II prefer distributed generation to cumbersome environmental impact assessments for conventional solar farms.

2. Grid balancing and energy pricing

The 2023 wholesale electricity price is at €105.11/MWh and has an upper shadow of more than €0.86/kWh, which means the number of sunny days for solar energy is ultimately independent. Following the Ukraine war, price volatility turned Spain into a net electricity exporter(8.4 TWh in 2024), attracting many companies with off-grid and mobility propositions.

3. Bureaucratic red-tapism and land shortage

Why occupy farmland in industrial centers such as Madrid and Barcelona? Compared to conventional configurations, foldable box installation space has been reduced by 80 percent (a 1-MW system should occupy fewer than 100 square meters, while ground-mounted conventional panels would occupy 5,000-8,000 square meters). The installation does not require any conception permit, so the installation time is reduced from months to days.

Spanish Business Economic Benefit: Cost Calculation

1. Initial investment and long-term savings

Price of a foldable system:

- Small units from 10 to 60 kWh: 30,000 to 50,000 euros inclusive of storage.

- Industrial units from 40 to 80 kWh: 80,000 to 120,000 euros.

Traditional Solar Farms:

- 50,000 to 70,000 euros for each MW, excluding the cost of installation equipment (land rent and construction permit costs).

2. Tax incentives and subsidies

- Limit-less 30% of IDAE grants can be funded from hybrid system costs.

- Property tax optimization-optimization of the containerized mobile property tax (IBI) would mean saving 15,000 euros per year for a 1 MW unit.

3. Comparing return on investments

- Foldable system, 4 to 6 years for business clients (8 to 10 years for home clients).

- Traditional power purchase agreement model: with no mortgage fees, the profits are typically deferred for 7 years.

Technical Advantage: Performance Features That Matter

1. Weatherproofing

Spain has considered this beforehand. They include:

- An anti-sand coating just as in the Aragon Desert.

- An IP68 watertight design like the Levante Coast.

- Sony devices resist proof against 47°C.

Illustrating, at Murcia, the anti-rust tanks with which they have energy stored for their wine caves are 40% unit energy costlier.

2. Storage integration and productivity

- 2 HJT panels show an efficiency of 24% which is markedly higher than the average efficiency in Spain of 20%.

- Hybrid lithium batteries have a round-trip efficiency of 95%, and this is best at the peak of electricity prices in Spain.

Competitive Landscape: Localization Strategies and Key Players

European players: A market leader HCI Energy working under low exposure to Chinese players like Antaisolar (20% cost cut from Spanish subsidiaries).

Local Joint Ventures: IDAE is subsidizing Enel Green Power and Iberdrola to provide containers for temporary workplace occupancy take-up and free-standing farms.

Future Growth and Challenges: Opportunities

- Market Growth:

- By 2030, an estimated €120 million (20.5% CAGR) focused on industrial and emergency applications.

- Cool Trends:

- All-in-One Systems: Spain logistic warehouse solar storage and storage for EV.

- Second-Life Batteries: Cost-benefit analysis for the recycling of EV containers.

- Challenges:

- Back-flipping regulation on self-consumption.

- Compatibility with factory UNE-EN 61646 for non-EU manufacturers.

Ride Spain's Solar Wave: folding solar box, seven-dollar plaster fix-Spain's Willy Wonka golden ticket for independence. As for policy support, full speed ahead to those profit windows in sunshine have been opened for the long-term players. For long-term investors, it is a question of when, not if.

Why Spanish Businesses Are Switching

| Factor | Foldable Containers | Traditional Solar |

| Deployment Time | 3–7 days | 6–12 months |

| Space Efficiency | 1 MW in <100 m² | 1 MW needs 5,000–8,000 m² |

| Tax Savings | No IBI property tax | Subject to full IBI rates |

| Policy Alignment | Priority for EU subsidies | Dependent on PPA auctions |

2025 Spain Solar Policy Guide: Free sign-up.

- Estimate Savings: ROI calculation in your factory with our interactive tool.

- WhatsApp Tip: Book a one-on-one advisory session with our Madrid-based energy experts.

- Sources: Spain's Ministry for Ecological Transition (MITECO), UNEF, QYResearch, Energy Box.

Sense, place, technical need, and available information all conspire to render foldable solar boxes the end destination of Spain's energy transition—at increased profitability and sustainability to the same rhythm.